GIVING

IRA Gift Giving

Are you 70 ½ or older?

Are you Catholic and own an IRA?

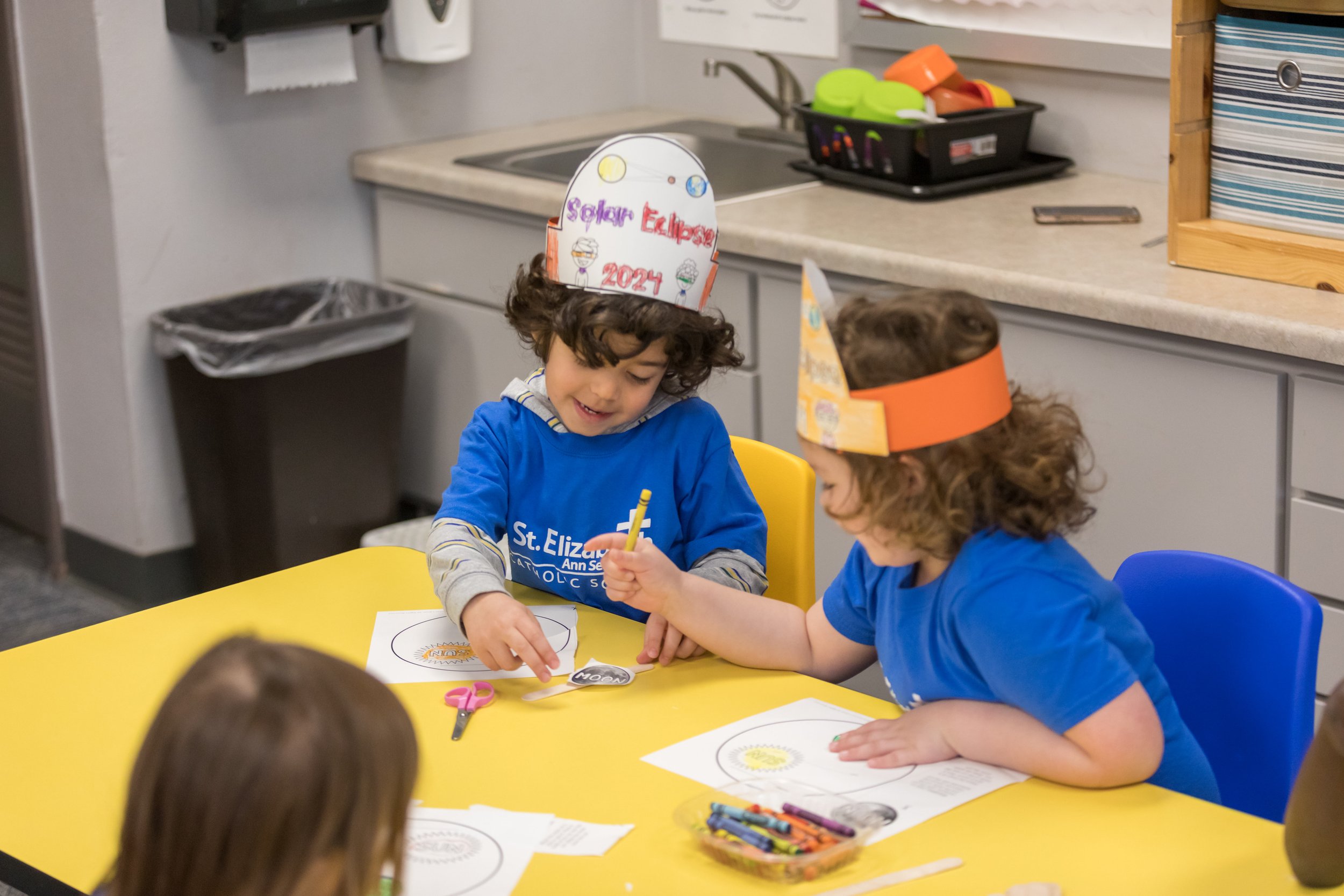

Here is a way to receive tax benefits while helping to pass your faith on to the next generation; or help children who want to have a Catholic education ; or support seminarians today, so that we will have great priests tomorrow.

Individuals who are 73 or older are required to take annual required minimum distributions from their IRAs which are taxed as ordinary income. A qualified charitable distribution (“QCD”) may be paid from the donor’s IRA directly to a qualified charity, such as the Catholic Foundation for the Diocese of Saint Cloud. The QCD will count against all or part of the donor’s annual required minimum distribution, which means that the QCD passes to the charity income tax free and the donor, likewise, doesn’t have to pay the income taxes otherwise required for the required minimum distribution. In 2024, a donor can make a QCD of up to $105,000 to a qualified charity, such as the Catholic Foundation and will be allowed to take the standard deduction. The donor can arrange with his or her IRA custodian to pay the QCD directly to any of our funds that are not donor advised.

The Foundation is a separate, stand-alone corporation that supports all things Catholic through grant-making, sponsorships, and assistance for those who desire to leave a legacy of life-long stewardship.

We can help align your giving with Catholic Foundation funds that mirror your values of formation advancement and pro-life initiatives. With your faith-focused, planned giving strategy, you can make additional gifts for years to come.